SBU exposes transit and conversion groups serving importers from southern Ukraine

The Security Service of Ukraine has documented the illegal activities of interregional transit and conversion groups, which provided tax evasion services to importers from southern Ukraine involved in smuggling schemes.

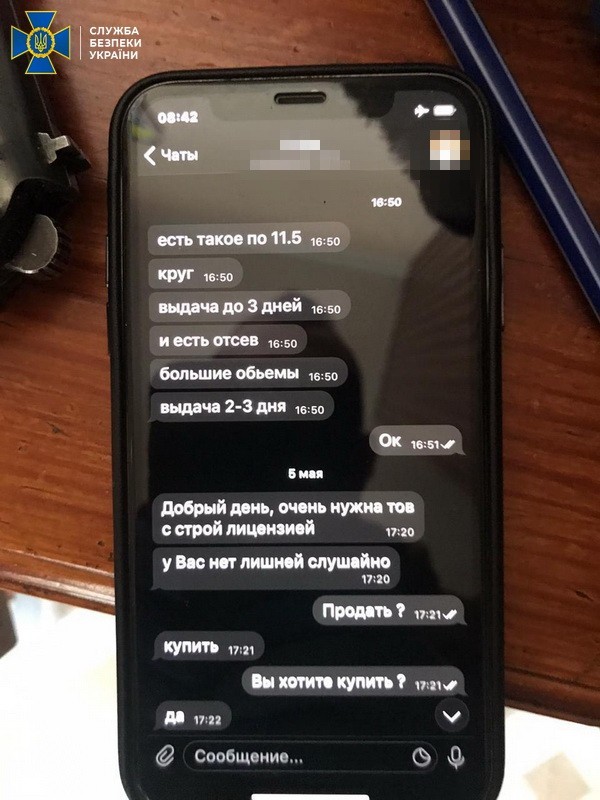

According to the pre-trial investigation, SBU officers established that the organizers used a scheme of artificial creation of a technical import tax credit. They also concluded non-standard export deals under the commission's contracts with business entities for further supply of products abroad. This makes it possible for criminals to have a negative tax credit value and reduce the tax burden. The scheme allows submitting unlawful applications for VAT refund to enterprises with tax benefits.

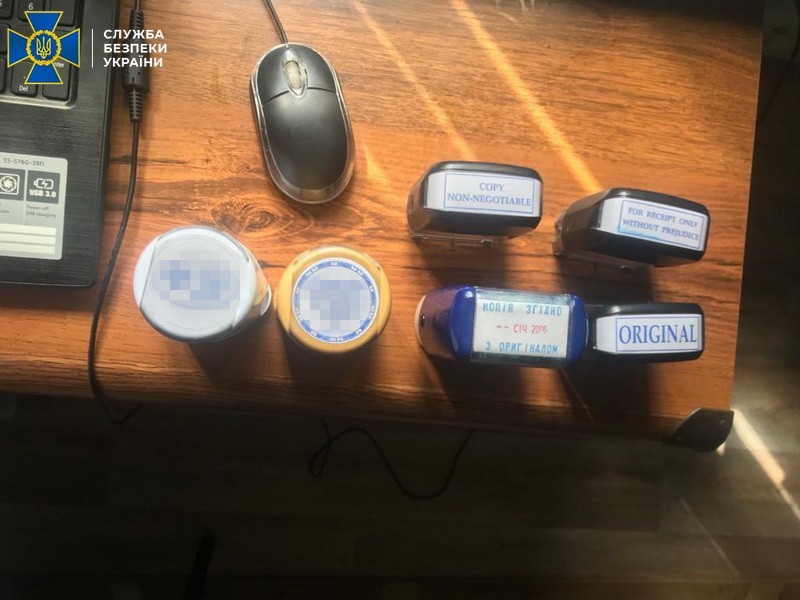

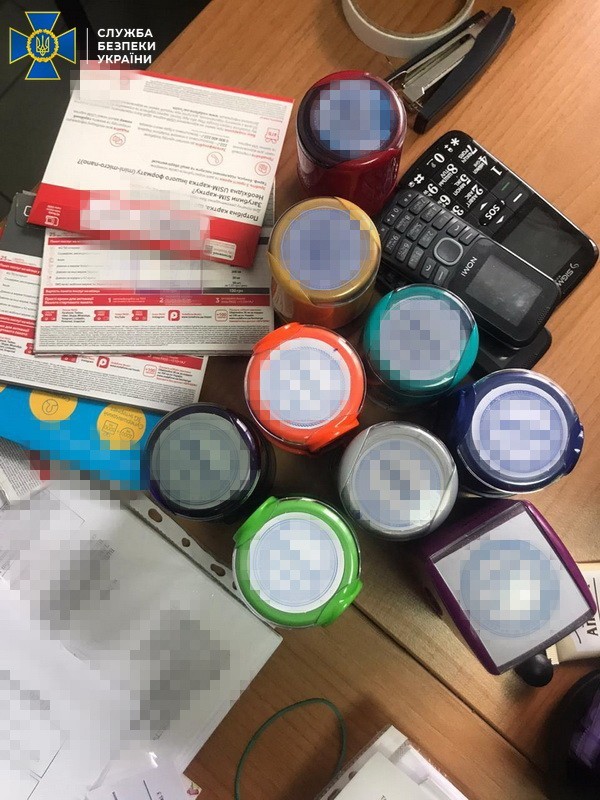

During searches at 32 places in Odesa region, at the suspects’ work places and houses, law enforcement officers seized almost 80 seals of enterprises and non-resident enterprises. Passports of citizens of foreign countries, cash, electronic data storages, a large amount of financial and economic documentation on the relationship between enterprises in the real economy sector and fictitious enterprises and "purchase and sale" of artificial tax credit illegally obtained from import enterprises were found as well.

Currently, almost UAH 600,000,000 of VAT limits have been arrested on treasury account.

The pre-trial investigation is continuing.